Hey there, are you tired of spending hours juggling payroll and scheduling tasks? Well, you’re in luck because using payroll and scheduling software can make your life a whole lot easier. From eliminating human error to streamlining processes, these tools offer a wide range of benefits for businesses of all sizes. Let’s dive into the advantages of incorporating payroll and scheduling software into your daily operations.

Benefits of Using Payroll and Scheduling Software

Payroll and scheduling software are powerful tools that can streamline the process of managing employee schedules and payroll. These programs offer a wide range of benefits to businesses, making them an essential tool for companies of all sizes. Here are some of the key advantages of utilizing payroll and scheduling software:

1. Time and Cost Efficiency: One of the primary benefits of using payroll and scheduling software is the time and cost savings it offers. By automating the process of calculating employee hours, generating paychecks, and creating schedules, businesses can significantly reduce the time spent on administrative tasks. This means that HR and payroll staff can focus on more strategic and value-added activities, improving overall productivity and efficiency within the organization. Additionally, by streamlining these processes, businesses can also reduce the likelihood of errors, saving time and money in the long run.

Furthermore, payroll and scheduling software can help businesses save money by optimizing employee schedules. These programs can analyze factors such as labor costs, employee availability, and workload requirements to create efficient schedules that minimize overtime and reduce labor costs. By optimizing schedules, businesses can better manage their resources and improve profitability.

In addition to time and cost savings, payroll and scheduling software can also improve compliance with labor laws and regulations. These programs can automatically calculate overtime, track employee hours, and ensure that schedules align with labor laws, reducing the risk of costly compliance errors. By staying compliant with regulations, businesses can avoid fines and penalties while also promoting a positive work environment for employees.

Overall, using payroll and scheduling software can result in significant time and cost savings for businesses. By automating administrative tasks, optimizing schedules, and ensuring compliance with labor laws, these programs can help businesses improve efficiency, reduce errors, and save money in the long run.

Key Features to Look for in Payroll and Scheduling Software

When choosing a payroll and scheduling software for your business, it is essential to look for key features that will make your life easier and streamline your processes. These features can vary depending on the size and needs of your organization, but there are some common ones that you should consider:

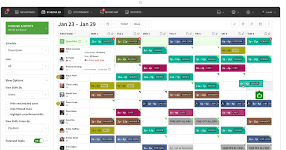

1. User-friendly interface: The software should have an intuitive and easy-to-use interface that allows you to navigate smoothly and quickly. Look for a solution that provides clear and simple menus, customizable dashboards, and easy-to-understand reporting options. This will help you and your staff to quickly adapt to the new system and make the most out of its functionalities.

2. Integrated scheduling capabilities: One of the key features to look for in payroll and scheduling software is integrated scheduling capabilities. This means that the software should allow you to create and manage employee schedules within the same platform as your payroll processing. With integrated scheduling, you can easily track employee hours, forecast labor costs, and ensure compliance with labor laws and regulations. This feature can save you time and effort by eliminating the need for separate scheduling tools or manual data entry.

3. Automated payroll processing: Another important feature to look for is automated payroll processing. This feature allows you to set up payroll schedules, calculate wages, deduct taxes and benefits, and generate paychecks automatically. By automating these tasks, you can reduce the risk of errors, save time on manual calculations, and ensure timely and accurate payments to your employees. Look for software that offers customizable payroll rules, direct deposit options, and tax filing services to simplify your payroll process further.

4. Employee self-service portal: A great feature to have in payroll and scheduling software is an employee self-service portal. This portal allows your employees to view their schedules, request time off, update personal information, and access pay stubs online. By providing this self-service option, you can empower your employees to manage their own schedules and information, reducing the administrative burden on your HR department and improving overall employee satisfaction.

5. Mobile accessibility: In today’s fast-paced world, it is essential to have software that is mobile-friendly. Look for a payroll and scheduling solution that offers mobile accessibility, allowing you and your employees to access the system on the go from any device. This feature enables flexibility in managing schedules, approving time off requests, and reviewing payroll information, making it easier to stay connected and informed even when you are away from the office.

By considering these key features when selecting a payroll and scheduling software for your business, you can ensure that you are investing in a solution that meets your needs, simplifies your processes, and enhances efficiency across your organization.

Integration of Payroll and Scheduling Software with Other Systems

One of the key benefits of using payroll and scheduling software is its ability to seamlessly integrate with other systems within an organization. This integration ensures that data flows smoothly between different platforms, eliminating the need for manual data entry and reducing the risk of errors.

One common system that payroll and scheduling software can integrate with is a time and attendance tracking system. By syncing these two systems, businesses can accurately track employee hours worked and ensure that payroll calculations are based on accurate data. This integration also streamlines the process of generating employee schedules, as managers can easily see when employees are available to work based on their recorded hours.

Another important integration for payroll and scheduling software is with human resources management systems (HRMS). By linking these systems together, businesses can ensure that employee information is consistent across all platforms, from scheduling to payroll to benefits administration. This integration also allows for better visibility into employee performance and compliance with labor laws and regulations.

Furthermore, payroll and scheduling software can integrate with accounting systems to streamline the process of financial reporting and budgeting. By syncing payroll data with accounting software, businesses can easily track labor costs and allocate resources more efficiently. This integration also ensures that payroll expenses are accurately reflected in financial statements, making it easier for businesses to make informed decisions about their budgets.

Additionally, payroll and scheduling software can be integrated with customer relationship management (CRM) systems to improve customer service and satisfaction. By linking these systems together, businesses can ensure that employees with the right skills and availability are scheduled to work during peak hours when customer demand is high. This integration also allows businesses to track customer interactions and feedback, enabling them to make data-driven decisions to improve the customer experience.

Overall, the integration of payroll and scheduling software with other systems is essential for businesses looking to streamline their operations and improve efficiency. By connecting these systems together, businesses can ensure that data is accurate and up-to-date across all platforms, leading to better decision-making and overall performance. This seamless integration also allows businesses to focus on their core activities, rather than spending time on manual data entry and reconciliation.

How Payroll and Scheduling Software Can Streamline HR Processes

Payroll and scheduling software can be a game-changer for HR departments looking to streamline their processes and increase efficiency. These software solutions offer a wide range of features that can benefit HR professionals in various ways. Here are some of the key ways that payroll and scheduling software can help streamline HR processes:

1. Automation of tasks: One of the biggest advantages of using payroll and scheduling software is the automation of tasks. These software solutions can automate a wide range of HR tasks, from payroll processing to scheduling employee shifts. This automation helps to reduce the time and effort spent on manual tasks, allowing HR professionals to focus on more strategic initiatives.

2. Centralized data management: Payroll and scheduling software often come with centralized databases that store all relevant HR information in one place. This centralization of data makes it easier for HR professionals to access and update information quickly and efficiently. It also reduces the risk of errors and ensures that all data is accurate and up-to-date.

3. Improved communication: Payroll and scheduling software often include communication tools that allow HR professionals to easily communicate with employees. These tools can include features such as email notifications, messaging capabilities, and automated reminders. By improving communication between HR and employees, these software solutions can help to ensure that everyone is on the same page and reduce the risk of misunderstandings.

4. Enhanced reporting and analytics: Another key benefit of payroll and scheduling software is the ability to generate detailed reports and analytics. These reports can provide valuable insights into various HR metrics, such as employee attendance, performance, and turnover rates. By analyzing this data, HR professionals can identify trends, make data-driven decisions, and optimize their processes for greater efficiency.

Furthermore, these reports can also help HR professionals to track compliance with labor laws and regulations, identify areas for improvement, and measure the effectiveness of HR programs and initiatives. By having access to this data, HR departments can continuously refine their processes and strategies to better meet the needs of their organization.

In conclusion, payroll and scheduling software offer a range of features that can help streamline HR processes. From automation of tasks to centralized data management and enhanced reporting, these software solutions can significantly improve the efficiency and effectiveness of HR departments. By investing in payroll and scheduling software, organizations can save time, reduce errors, and make more informed decisions to better support their employees and achieve their business goals.

Security and Compliance Considerations for Payroll and Scheduling Software

When it comes to handling sensitive employee information and managing schedules, security and compliance considerations are of utmost importance. Payroll and scheduling software are essential tools for businesses to streamline their operations, but without proper security measures in place, companies can be at risk of data breaches and non-compliance with regulations.

One key security consideration for payroll and scheduling software is data encryption. Encryption ensures that sensitive information, such as employee social security numbers and salary details, is protected from unauthorized access. It is important to choose software that uses strong encryption protocols to safeguard data both in transit and at rest.

Another important security feature to look for in payroll and scheduling software is multi-factor authentication. This extra layer of security helps prevent unauthorized access to the system, even if login credentials are compromised. By requiring users to verify their identity through multiple factors such as a password and a one-time code sent to their phone, companies can reduce the risk of unauthorized access.

Regular software updates are also essential for maintaining the security of payroll and scheduling systems. Software vendors frequently release patches and updates to address known security vulnerabilities. By keeping the software up to date, businesses can protect themselves from potential security risks and ensure that their data remains secure.

When it comes to compliance considerations, businesses must ensure that their payroll and scheduling software meets all relevant regulations and industry standards. This includes compliance with data protection laws such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA).

Companies must also consider compliance with labor laws and regulations when it comes to scheduling software. For example, some jurisdictions have strict regulations regarding employee work hours and breaks. It is important for businesses to choose scheduling software that can help them track and manage employee schedules in compliance with these laws.

Additionally, businesses must consider compliance with payroll tax laws when choosing payroll software. Payroll software should be able to accurately calculate and withhold payroll taxes according to federal, state, and local regulations. Failure to comply with payroll tax laws can result in costly penalties and fines for businesses.

In conclusion, security and compliance considerations are crucial when selecting payroll and scheduling software for your business. By choosing software that prioritizes data security, encryption, multi-factor authentication, and regular updates, businesses can protect themselves from data breaches and unauthorized access. Additionally, ensuring compliance with relevant regulations and industry standards will help businesses avoid potential legal consequences and financial penalties. Prioritizing security and compliance when choosing payroll and scheduling software will ultimately benefit both the company and its employees.